Why does the majority of people lose money in the financial market? The answer to this question can be divided into two folds, and you will learn both in this article.

What works in trading and investing the financial market?

Market speculation is one full world consisting of everybody, ranging from active day traders to longer-term investors, with all of them involved in the speculation of all kinds of asset classes and markets. There are several individuals across the universe, stimulating buy and sell options daily with the hopes of raking in more wealth and income. Never in the history of trading has there been as many books authored on the right ways of speculating in financial market for investors and traders more than now. Educational seminars on how to get rich via trading are hosted every weekend across various cities. However, despite the wealth of education on the correct ways of speculating the market, why do people still lose money? The answer to this question can be divided into two folds, and you will learn both in this article.

First, most people still lose money because a better percentage of these seminars and books are usually loaded with knowledge (conventional fundamental and technical analysis) on how to trade along with the market. That is, how to buy when all other traders are buying, and also how to sell when all other traders are selling. This, however, results in high risk, low probability, and of course, little reward.

Conventional technical analysis, as mentioned in the previous sentences, is based on recognition of patterns that include individuals buying upon rallying of the price, plus offering sell and buy signals which are based on oscillators and indicators. However, these oscillators and indicators always price-lag, which translates to higher risks in buying and selling. Also, the conventional fundamental analysis offers traders buy signals in situations whereby company numbers are reliable, and good news is present, but by then, the price of the company’s stock is already high. Besides, you should always remember that to make profit consistently, you need to employ a strategy that allows you to buy before others buy and also sell before others sell. This way, you will be sure that others would be buying at prices higher than the amount you purchased yours, and also selling at prices lower than the amount you sold yours. But, if carefully observed, you will realize that both conventional fundamental and technical analysis doesn’t help traders in this regard. Basically, what these two means of trading teaches is to sell and buy with the crowd – usually when it is too late, therefore resulting in higher risks, and also no real edge.

Secondly, traders lose money because they disregard simple logic when making buying and selling decisions. This reason, too, is a prerequisite to the first reason discussed in the previous paragraph. Let’s take, for instance, if you want to buy a car, and the dealer names the car-price to be $20,000, you obviously won’t outrightly declare: “I love this car, can I pay $30,000 for it instead? Of course, you won’t do that. Instead, you would suggest: “can I pay $17,000?” or paying even something lesser. However, when trading, most persons delay buying until they get confirmation of higher prices. Whereas, this is in direct opposite of how things are done outside of trading. And really, it makes no sense.

Basically, before you begin to trade, it is essential that you have prior knowledge of how to make money via the buying and selling of things. This way, learning how to trade would be quite easy for you, and also your mentor won’t have tough times taking you through his or her classes. The thing is, there won’t be anything really in trading – buying and selling – that your mentor would want to teach you that you won’t have prior knowledge of.

For example, here at our online trading academy, we once had a newbie who wanted to learn how to trade right. We understood that this person used to have a pizza shop, which he already sold. During his first session, we made him tell us about his business, which of course, he did. We furthered by asking him three questions related to his previous business: 1) what was the average price of pasta? “about $2.00 a pound,” he replied. 2) What if there is an increase in the average price of pasta, how much will you plan to buy? “as much as I need,” he replied. 3) what about a reduction in the average price, how much will you buy? “as much as I can store,” he replied. After this session with him, we were already convinced that he, indeed, is a great buyer. And we were actually right. As a matter of fact, there is basically nothing that we want to teach him about trading that he doesn’t know already. The only new thing we needed to teach him was to get acquainted with how proper selling and buying appear on price charts. Why? Because this particular person was already selling and buying commodities in the regular market, just that he didn’t know what buying and selling looked like on price charts. And because of his solid foundation, it was quite easy for us to take him right through the classes.

Consequent to the above example, this article seeks your understanding of the fact that the more you apply the rules and mindset that you make use of when buying and selling items from the regular market such as the appliance store, grocery store, etc., into your market speculating, then the better you will thrive in this regard. For instance, if you have ever made use of coupons to save yourself some money, then definitely, you already know how to purchase things at lower prices. This exact mindset is what you need to take into your world of investing and trading. However, there is a mass illusion that regular trading in real life is somewhat different from proper investing and trading. Well, now, we put it to you that there is no difference, and that is the truth.

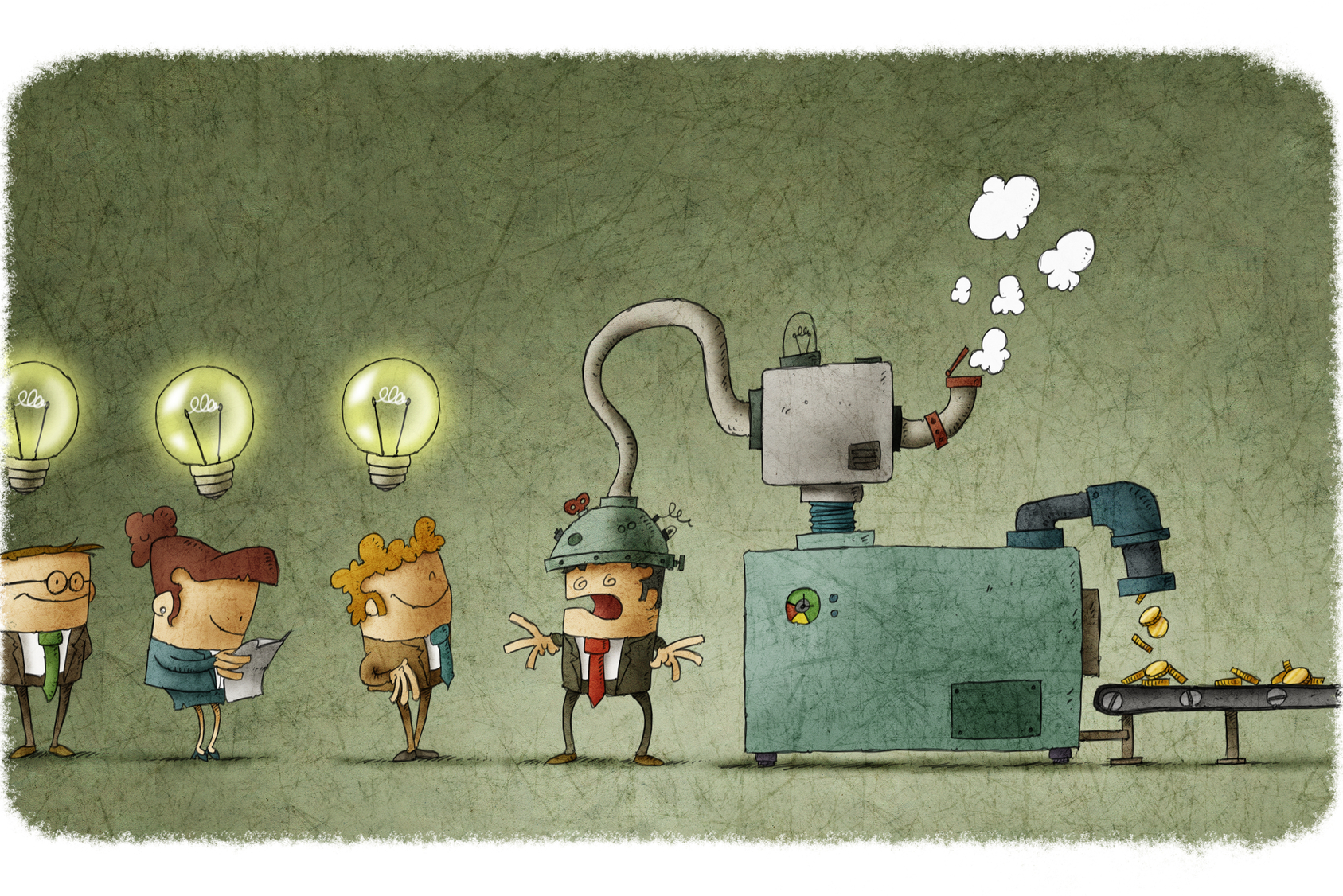

The thing is, many self-acclaimed professionals and experts will deliberately want to complicate the trading process making use of mirrors, smoke, sleight of hand, and curtains. And the reason for this is because they know that this way, you will most likely transfer money into their accounts without you being conscious of that. Nonetheless, the key for you is to ensure that you are keeping everything “real.” Make sure that you are making use of your simple logic, such that you can effectively filter. This way, you will be assured of not losing some or all your accounts to illusion. For clearer understanding and review, let us evaluate a trade from one of our live trading sessions.

At the moment, the Crude Oil market is desperately falling, and this way, it is reaching the “objective weekly demand zone” as determined by our strategy. You will see most persons refraining from buying because of the little downtrend, and all books instruct that traders shouldn’t buy in or during a downtrend. Besides, there might have been bad news too, thereby causing a fall that would either scare people from buying at that level or make them nervous. So, instead of buying, most people sell in this circled area.

Now, what if we change the market to one for smart TVs. Take, for instance, there is a smart TV, known to be typically expensive, but at that moment sold at an incredibly low price. Will you want to buy it or otherwise? Of course, you will be agitated to buy such a TV at a discount. But then, why is everybody having yet two different and opposite emotions or feeling with these two examples? Well, it is simple; it is because while one is a financial market, the other is an example of our day-to-day buying and selling in real life. Also, and perhaps, most importantly, most of us have been brainwashed to believe that making money from selling and buying in a financial market either as an investor or trader is somewhat different from making money from selling and buying anything in life.

Now, back to our trade. As expected, the prices turned higher, therefore presenting low-risk profits to us on that particular trading opportunity. That fact is that Crude Oil was actually on sale for a somewhat limited period, and consequently, there was just a small amount left for sale at such a price, which means that after all this amount have been bought, there would be a rise in price. You will find all this information in the chart, especially if you have a perfect understanding of the basic Supply and Demand strategy.

However, do not get us wrong; there is actually nothing wrong with following the rules and guidelines stated in trading books. It’s just that you need to ensure that you are the author of such a trading book and also that your strategy aligns with you buying and selling at wholesale and retail prices, respectively. To achieve this, you need to first start by applying the powerful selling and buying knowledge you already possess and use daily outside the world of trading. After that, introduce this simple strategy into your trading and trust us, you will soon be spotting “blue light specials” all over the place.

In summary, what we are saying is that making money from buying and selling anything in life is precisely the same as making money from buying and selling in financial markets.

The principal rule – Keep it simple

Perhaps you are wondering why, well, it is because “simple” is the new trend – it is what works. To expound on our stance, and confirm for yourself if being simple is actually the best approach, let us take a look at a few unrelated examples. Unrelated? Well, you will know why soon. Let’s move!

Have you ever visited a gym where they provide personal training? If you have, then you must have also realized several new exercises going on during individual training sessions, including people standing on one foot or a big rubber ball, engaging in arm curls, and so on. And really, the advancements are significant. At least, it gets more individuals to visit the gym. Now, the point we are driving at is that, if you walk into a gym for the first time, try to be intentionally observant. There, you will notice that those with the best body fitness and body shape are actually those engaging in simple exercises. The thing is, the narrative hasn’t changed – you need to get calories out of your body, and in tandem, simple workout routine works. You necessarily do not need an expensive gym, no matter what the hype may be. More often than not, these things do next to nothing in making you have the best body shape. Instead, you need just a simple solution; low calorie, well-balanced, and low-fat diet is what you need.

Now let us get back to market speculating. With being honest with yourself, have you ever seen anyone who consistently makes a low-risk living off the use of price charts that are filled with indicators? As much as these items are included in every trading book, and they can be used as much as people want, we do not know anyone who makes a consistent living via the use of all that stuff. Walmart, for instance, is one of the most successful establishments in the world, and you can affirm for yourself that they have mastered just one skill, which is buying when the price is low and selling when the price is a bit higher. This is what Walmart repeats several thousands of times daily. However, most people think that how Walmart makes its money is quite different from how a regular trader can make a consistent living when trading off the financial markets. However, it is wrong. Factually, there is no difference at all.

What Walmart does is buy his commodities at wholesale prices, and then sell it to us at retail prices. This way, you will find them mostly selling things to us at prices that are incredibly cheaper than those of their competitors. And this is one of the reasons they are one of the top traders in the industry.

Now, here is a perfect example of trading that we made in one of our trading classes; there is no difference when Walmart sells at retail prices, and when we also trade. Just that, instead of us selling toiletries at retail prices, we will be selling EURUSD to someone willing to pay a retail price for it. Now, such a buyer may use one of the items mentioned in initial examples as a buy signal. But then, it is quite unfortunate that most people fail to realize that what these tools do is give you buy signals at retail prices and make you sell them at wholesale prices.

Another justification that the simplest answer is typically the best answer to your trading strategy questions is the OCCAM’S RAZOR principle. This principle suggests that amongst all the clues that you are provided with, the simplest of them is the right one. So, in case you are a trader or investor, and your results aren’t what you are expecting, then we advise that you examine all the components of your plan, and also begin to ask questions on parts that may seem complicated to you. Most likely, what will get you to where you desire to be is a set of “simple” answers.

If you want to learn more about professional trading and investing across multiple asset classes such as forex, futures, and stocks, please sign up HERE for free at our online trading academy www.onlinetradingcampus.com and get access to a free three-hour introductory course.

Happy trading!

Author Bio: Bernd Skorupinski teaches the undiluted truth about trading and investing at Online Trading Campus and takes you through what it takes to be a consistently successful trader. His favorite moment as a trading mentor is the way peoples’ eyes light up with excitement and confidence when they understand how Supply and Demand trading strategy works and how it can help win in the trading arena. He believes in building core values and discipline that ensures his students do not succumb to the pressures and temptations of the market. He very much believes in following plans and strategy through. If you want to know more about the author Bernd Skorupinski please read HERE