In this article we cover some cogent and mind-blowing facts on how to multiply your money by using compound interest in the forex, futures, and stock market.

The irrelevance of winning percentages in trading and investing in the financial market

We would be analyzing and debunking the popular belief about winning percentages that most new forex, futures, and stock traders and investors have and what the actual relevance is. Let us get something straight; the win rate or percentage is of zero significance on its own. It does not have a finite role to play in deciding how efficient a trading and investing system is or how good a trader is. It is still quite possible to lose money with an 80%-win rate if you fail to manage your losses well. However, you can always be profitable with just a 30%-win rate if you’ve mastered how to let your wins ride and cut your losses short.

“It is not about how often you are right or wrong, but it is all about how much money you make when you are right, and how much you lose when you are wrong.” – George Soros. It all boils down to your risk to reward ratio.

Mastering and understanding how the risk to reward ratio works is the key to being profitable. A forex, futures, and stock trader and investor who understands the intricacies of this will significantly increase their chances of being profitable. A lot of us tend to associate winning and being continuously right with being successful. It might be applicable in some cases like in a 9 to 5 work environment, making many mistakes on the job would not get you a promotion, however, making a lot of right decisions would. Due to this widely accepted norm, it is not surprising that many people have transferred that mindset into trading and investing and have associated being right to mean profitability while being wrong to signify losing money and being a horrible trader and investor in the financial market.

Professional traders and investors have figured out that their win percentage has almost nothing to do with how profitable they are, while new traders tend to worry over their win rates which is a sad irony. Worrying about your winning percentage will not only negatively affect your overall trading psychology but will also have you worrying about the next trade before you even enter it. If all these seem a bit confusing, that’s perfectly normal, and we will try to clarify that by the use of showcasing two simple trading perfomance examples to give a more explicit and detailed description of precisely what we are talking about.

Forex, futures, and stock trading and investing is probably the only profession where you can be a net loser and still make money; that is why being right is not necessarily relevant in the trading arena.

How you can win 80% of your trades and still lose money

Our online trading academy gets many emails asking what the winning percentage of our trading system is, and we have always had the same answer: it varies, and it doesn’t matter. Of course, many people will get confused after an answer like that. Does winning percentage have an impact on the overall profitability of a forex, futures, and stock trader or not?

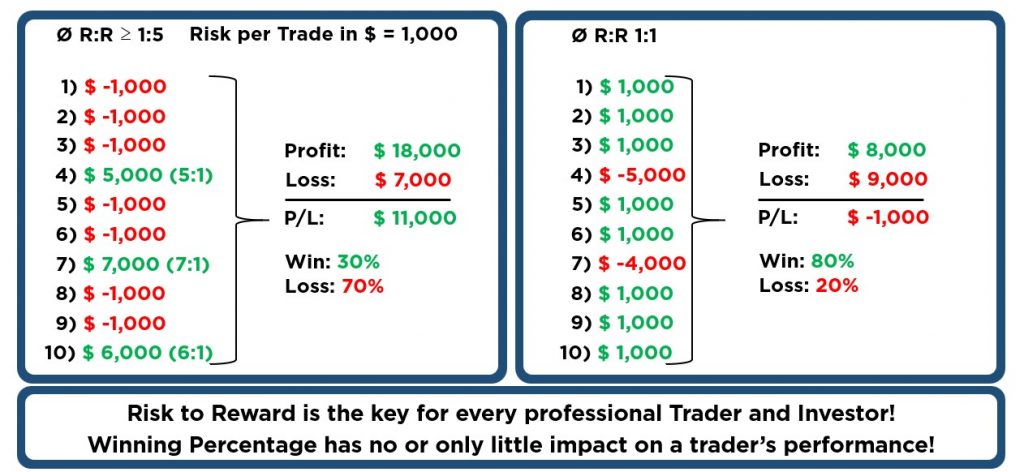

Examine a simple trading performance comparison below; it explains how a person can win close to 80% (in the right box) of their trades and still lose money. The sad thing is that the result below is somewhat familiar to several traders and investors. They allow their losses to destabilize them and let things get out of control. The goal is to ensure that your losses are small relative to your wins. The primary lesson from the second box below is the fact that just one or two losses if not well managed, can still lead to a significant loss.

How to still be profitable even at a 30%-win rate

Seeing that you now understand how you can still lose money even when winning a large percentage of your trades, we also show how you can still be profitable even when you are losing a more significant portion of your trades. It will help you understand better what we have been talking about.

The first thing to note in the performance comparison above (in the left box) is that the losing trades were set at -1 R:R (R:R means your per-trade dollar risk amount in relation to dollar reward) and all winning trades at values higher than 1R. Another thing to take note of is that there were more losing trades than wins. If you look closely enough, you would realize that the losing trades were about 70% while the wins were just 30%, but the account still made a substantial $11,000 or in total 11R’s. This only goes further to show that when it comes to losses, you only need to manage your risk to reward ratio exceptionally well.

The primary skill to master is how to manage your losses relative to your wins. If you can consistently make back twice what you lose on your losses, then you can still make a steady income.

Low win rates are also a lot more realistic in the long run, and learning how to make the most of each win is what will make you profitable in the long run. From the examples above, you can see that it is quite possible to win 80% of your trades and still lose more money than you make. Having your losses contained and making the most out of your wins will help in making you profitable, and by mastering your Supply and Demand trading and investing strategy, you would be able to pick more high probability trades.

Now that you understand how and why winning percentages are not relevant, it is important also to discuss the mechanism and way to go about making money while losing the majority of your trade.

Average risk to reward ratio

This is one of the most crucial money management skill to develop. We have spoken on this quite frequently in the past, but for those who might be a bit unfamiliar with it, know that it goes a long way to determine your profitability. It helps you to know how to place your stops and when to exit a forex, futures, or stock trade logically. You also have to decide the risk to reward of a trade before entering into it. You decide this by analyzing the current market condition and if you will be able to get your desired result with all these in place.

Keeping risk constant

There is a common mistake even the best of us make when we are just starting our trading and investing career, and it is to vary our dollar risk depending on the result of our last trade outcome. The reason this is a mistake is that the next trade outcome does not depend on the previous trade as long as you are trading with a plan and strategy, not from an emotional place.

New and inexperienced forex, futures, and stock traders tend to either increase their dollar risk after each win or reduce it after a loss. This is entirely emotional and isn’t advisable. You should keep your risk steady and focus on your trading plan.

Position sizing

Position sizing is the way to keep your dollar risk constant. Many forex, futures, and stock traders and investors are usually worried that trading higher timeframes like we advise means risking more. However, this is not so. Through position sizing, you can maintain the same dollar risk by moving your amount of lots, contracts, or shares up or down irrespective of the stop loss distance.

Conclusion

The last piece of advice is to master your Supply and Demand trading and investing strategy such that there is no guessing when you begin to trade. You know precisely what to search for in the charts. You should utilize proper money management principles, and enter trades only when it aligns with your Supply and Demand trading strategy, to guarantee your profitability.

Combining this with proper money management makes your win percentage unimportant. When you only enter trades when your Supply and Demand trading strategy tells you to, and you make use of appropriate money management principles, you will be profitable.

Check out our online trading academy to learn more about our lifetime mentoring program and daily live trading and investing classes.

If you want to learn more about professional trading and investing across multiple asset classes such as forex, futures, and stocks, please sign up HERE for free at our online trading academy www.onlinetradingcampus.com and get access to a free three-hour introductory course

Happy trading!

Author Bio: Bernd Skorupinski teaches the undiluted truth about trading and investing at Online Trading Campus and takes you through what it takes to be a consistently successful trader. His favorite moment as a trading mentor is the way peoples’ eyes light up with excitement and confidence when they understand how Supply and Demand trading strategy works and how it can help win in the trading arena. He believes in building core values and discipline that ensures his students do not succumb to the pressures and temptations of the market. He very much believes in following plans and strategy through. If you want to know more about the author Bernd Skorupinski please read HERE