In this article we explain the pros and cons of a buy and hold investor and a pro – active investor based on a case study.

The buy and hold investor vs. the pro-active investor

There are various types of investors; many people consider it wise to buy ETFs and hold for years because they believe the market value will increase, simply because a book said so. Before you make this decision, you really should consider your options, consider that it is your hard-earned money and you are taking all the risk. Before deciding to buy and hold, you need to ponder on the following extensively:

What is the success probability of the type of investment you are choosing? What is the risk percentage? Do you realize that the market moves in three different dimensions, up, down and sideways, and you have restricted yourself to just one of it? By limiting yourself, you have reduced your statistical probability to below 50%.

You might be thinking, but the market has always moved up, why should it stop now? If the market keeps moving up why do I have to worry? We’ll discuss all that in a bit with the case study below.

Nikkei equity index case study

Let’s explain what buy and hold analysis is all about. It examines the history of the market, 30 to 40years back and proposes that the same trend will continue. The buy and hold investors assume they will get the same rate of returns. This exact line of reasoning is where the big problem is, and here is why: PAST PERFORMANCE DOES NOT DETERMINE FUTURE PERFORMANCE.

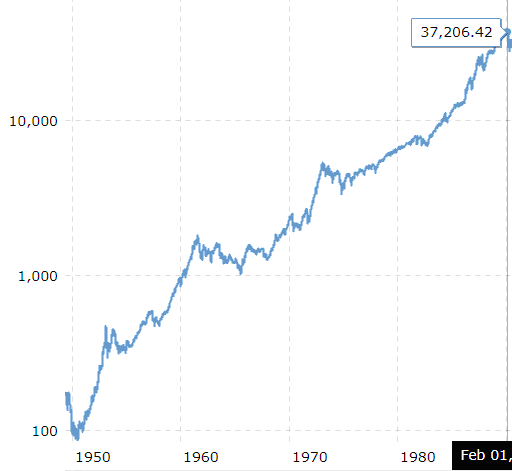

This type of analysis and conclusion is extremely misleading because it only considers the past data and not future predictions. This is usually referred to as the lagging effect. To properly analyze the future of the price, we not only consider the data from the past but we also carefully examine the prospects of the future as this is the most important one, because the past to a considerable extent, does not determine the future and the market is quite dynamic. For example, have a look at the Japanese equity index in 1990.

You might assume that the market will keep rising, and therefore consider a buy and hold investment, but here is where we are today.

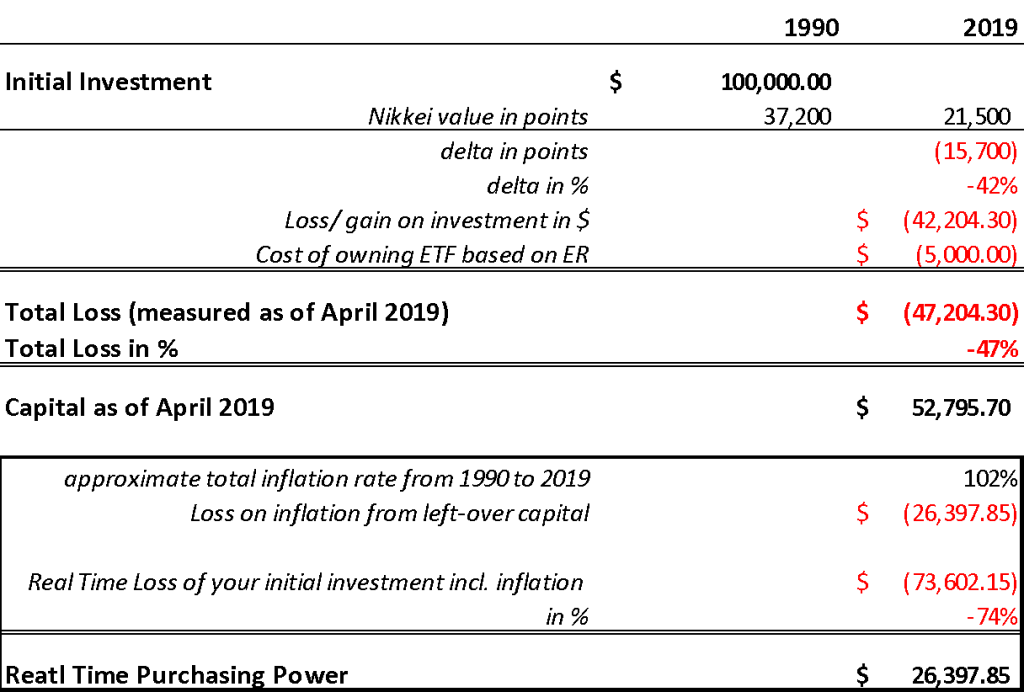

Let’s examine the Nikkei equity index as at April 1st, 2019, which is trading 21,500 units when compared with the 39,000 units it was trading in 1990, which implies that there has been a 42% decrease in price. Let us establish the effect of this using an example: Assuming you invested $100,000 as at 1990 while using the buy and hold method, we’ll be calculating the cost of owning ETF for approximately 30years and also the effect of inflation which determines the buying capacity of your money in 2019.

We agree that there are stronger equities than the Nikkei, equities like U.S. S&P500 or Nasdaq. The whole point of this is trying to explain and make you understand that past performance does not give you the correct future predictions of a particular equity and it doesn’t educate you on the interest of your capital investment.

In most cases a “buy and hold” investment should be changed to “buy and hope,” very rarely is the execution professional, or we dare say even wise to invest your hard-earned money without a proper understanding and study of the potential risk and the reward. You are just throwing your money in the air and hoping it comes back to you with interest, all you depend on is hope.

Don’t misinterpret us, we as an online trading academy understand that not all forms of buy and hold are bad. We are merely pointing out that like every other investment, there is a right and wrong way to go about it. Sadly, not many people understand this. You still need to be able to understand and time the market to know the right time to invest, know if the market will go sideways or downside for a while, understand inflation, cost of holding and opportunity cost. Not considering all of this will not only affect your account but it can also negatively affect your mental state tremendously. So instead of your money working for you, it would be working against you.

To succeed in this type of investment, you need to be able to time and predict the market. Some people would argue that Warren Buffet just bought and held, and this is how he accumulated wealth. Wrong! Warren Buffet was and still is a value investor. He looks at specific criteria before buying a specific stock or ETF. He would look whether a specific company or market is overvalued, undervalued or fairly valued and invest accordingly! Have you done your due diligence or are you just hoping for the market to go up without understanding your potential risk and reward?

We as an online trading academy can boldly tell you it is possible to time the market and predict potential risk, reward and also calculate the probability of success of an investment.

When it comes to predicting how the market prices turn, there are quite several ways to go about this. Some might say that Global economic reports and Health of cooperate profits help to determine and predict the movement of price because it states that when the data is weak, the market prices go down. If this analysis worked, and it was as easy as this, then everyone would be profitable investors.

The technical analysis method, however, focuses on price patterns on charts and supposedly helps you to predict the future of market turning prices before it happens. There are many issues with this method, but the biggest of all would be the fact that you are always one step behind, and you end up buying just after the market goes up and end up selling after there’s a decline.

We as an online trading academy provide a better option to how the market operates. Instead of making use of the traditional analysis methods, we’ll be using the “Buy and Sell orders,” in other words, Supply and Demand. To establish this example further, we’ll use a buying opportunity from S$P500.

Example: S&P500 example for a buy and hold investor

Study the chart above. Zone A (or the yellow boxes) refer to a Demand zone we outlined during a live trading webinar in December 2017. In this zone, it is clear that Demand greatly exceeds Supply. Therefore, this is the zone in which the banks and other financial institutions were buying and are likely to buy again.The imbalance between Supply and Demand will cause a rise in prices.

What happens when price retraces back into the Demand zone?

Point B relects the first time S&P500 price retraces back into our Demand zone A, and at this point, to be exact in October 2018, we as an online trading academy advice our students to buy. During this phase, the financial institutions are busy buying as well while the uneducated ones are busy selling out of fear and ignorance. The primary factor that contributes to the rousing of the price is lack of Supply.

Assuming you bought at 2364.50 as at December, in just four months there would be a 23.5% increase which translates to 2920.25.

Supply and Demand are the significant determinants of prices in all forms of market. Prices turn either way when there is a form of imbalance between Supply and Demand. The unfilled orders that cause the turning of the prices can be found and translated into the charts.

Example: Gold Example for a proactive investor

Let us also look at other asset classes, like commodities, to establish how a pro-active investor may benefit from timing the markets.

The yellow box is the Supply zone in which the financial institutions are selling, once Supply exceeds Demand, there is usually an automatic drop in prices. Once there is no Demand, prices will keep dropping. We as an online trading academy teach our students to sell when the “first re-test of Supply” has been reached. Banks and the well-informed are also selling at this point. The major factor contributing to the price decline is lack of demand and excessive Supply.

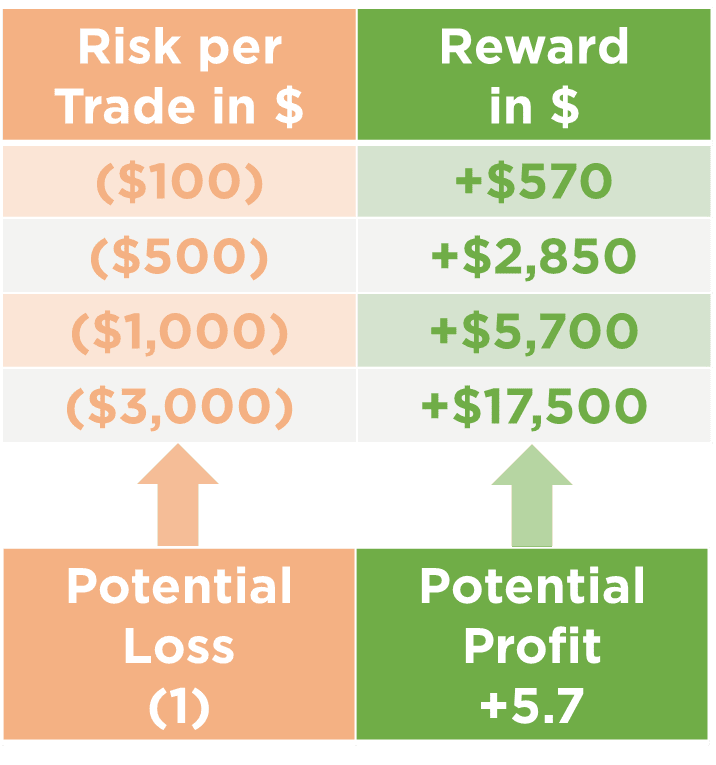

We are achieving a risk to reward ratio of close to 1 to 6. For a pro-active investor this means the following: For every dollar we risk per trade, we will make close to 6 times as much if the trade goes our way.

As an online trading academy, we show our students how they can put the odds of being successful in the financial market in their favor.

If you want to learn more about professional trading and investing across multiple asset classes such as forex, futures, and stocks, please sign up HERE for free at our online trading academy www.onlinetradingcampus.com and get access to a free three-hour introductory course.

Happy trading!

Author Bio: Bernd Skorupinski teaches the undiluted truth about trading and investing at Online Trading Campus and takes you through what it takes to be a consistently successful trader. His favorite moment as a trading mentor is the way peoples’ eyes light up with excitement and confidence when they understand how Supply and Demand trading strategy works and how it can help win in the trading arena. He believes in building core values and discipline that ensures his students do not succumb to the pressures and temptations of the market. He very much believes in following plans and strategy through. If you want to know more about the author Bernd Skorupinski please read HERE