Traders and investors must be prepared to tackle emotional challenges in their job. Read this article to understand the stages involved in trading psychology.

FINANCIAL MARKET CYCLES: WHEN GREED AND FEAR SEIZE POWER

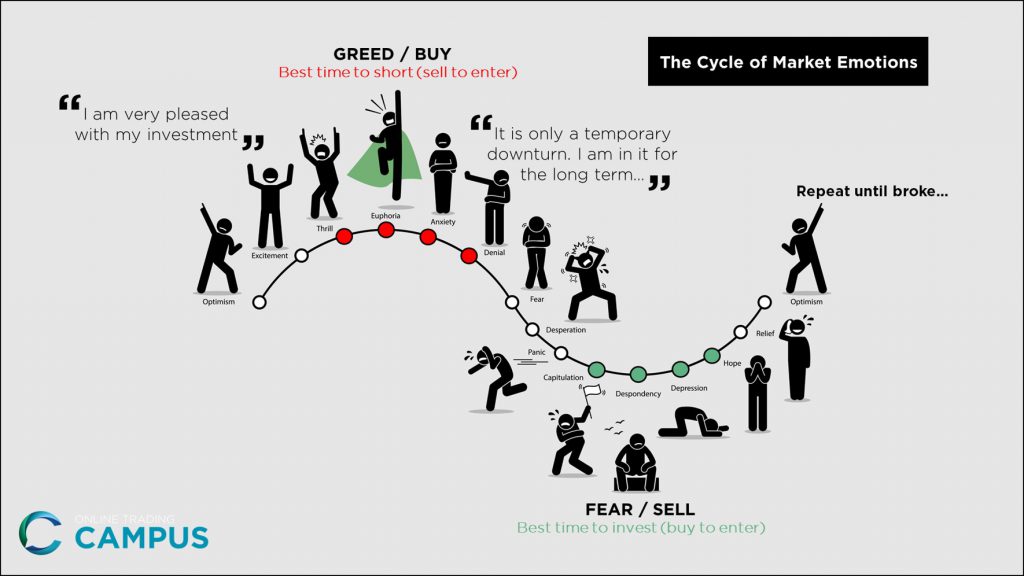

The financial market is not stable, and it is constantly evolving and going through different cycles that tend to have different effects on those who are participants in it. When the market is at its peak, traders and investors are usually happy and satisfied with the returns they get on their trades or investments, and they also assume that the market will stay at its peak for an extended period of time.

The mistake is in this assumption because then they begin to close their eyes to the obvious red flags that are meant to serve as a warning and to caution them. The initial good feeling is usually followed by a sense of nervousness and anxiety when the market starts moving in the opposite direction, and it starts turning lower.

Sadly, this is a result of the traders not having a predetermined Supply and Demand trading strategy and criteria and thus allowing their emotions to run the show. In most cases, they also don’t have a well-planned strategy to help them know when to get in and get out (buy low and sell high) of a trade. This poses a unique challenge to new and inexperienced traders or investors.

For traders and investors to be prepared to tackle these challenges, they need to understand the stages involved in trading psychology.

TRADING PSYCHOLOGY PHASES

THE EMOTIONAL REACTIONS OF AN UPTREND IN THE FINANCIAL MARKET

Optimism

Traders who bought a certain asset experience an enormous amount of optimism when the market has been in an upward trend for a certain period of time, because the potential for earning is extremely high, and the market is in its recovery phase. During this period, traders and investors feel compelled to buy more because they have interpreted risk to be minimal.

As the market proceeds to a higher level, optimism begins to translate into excitement because the early buyers are starting to make substantial profits on their sales, and every pullback or dip is seen as an opportunity to buy more. Buyers are usually rewarded when they buy during the pullback, and they will keep buying until that changes, which means they will keep buying until they are no longer rewarded for their actions.

Excitement and Thrill

As the market continues its upward climb, traders and investors begin to experience a bit of thrill. They begin to feel enthusiastic because of the substantial and notable increase in their profit. Traders and investors begin to feel extremely confident, and it tends to become exuberance.

Euphoria

This is the last and final stage of the upward trend. Profits become extremely easy to make, such that traders and investors begin to ignore the basics of risk management and then feel that they must take leverage to make more profit.

On the surface, everything seems perfect, but unknown to many, and this is the point of maximum risk in the upwards trend. Many people become blinded with greed during this phase. This is when institutional buyers know when to take advantage of such greed because there are so many willing buyers, which makes a lot of liquid cash available and makes it easy for them to sell off so many stocks and also to take the other side of the trade and enter a short position.

THE EMOTIONAL REACTIONS OF A DOWNTREND IN THE FINANCIAL MARKET

Anxiety

Buyers begin to reduce, and the market starts to experience a rollover. It might even be mistaken as a routine pullback initially, but it soon becomes obvious it isn’t, as it fails to reach the previous high watermark and the prior lows are breached. Now is when anxiety begins to set in, and previously easy profits are no longer easy to make. Also, earlier gains begin to diminish slowly.

Denial and Fear

This is a phase that begins with investors trying to find reasons why they decided to hold on to losing trades. They have convinced themselves that they have invested in good and profitable companies, and if they are patient enough, it will all pay off. With time, when things don’t get any better, and the losses continue to mount, the denial turns into fear. The fear at this point begins to translate into a form of paralysis, which basically handicaps most traders, and like a deer in the headlights of an oncoming car, they are confused as to what their next step should be.

Desperation and Panic

Traders start feeling a bit of desperation due to the persistent selling, and their previous determination to hold on for the long haul begins to deteriorate under the pressure of the market. Panic quickly moves in as the harsh reality of the situation they are in begins to become apparent, and traders start to understand the impact of each loss. The emotions caused by each loss begin to become too much to bear, and at some point, it gets totally overwhelming.

Capitulation

The more selling intensifies, the more the fear and pain of most traders increase. The capitulation is a point where most traders or investors give up, and they resolve to sell to reduce the pain and anguish they are in. This is usually a huge opportunity for most financial institutions as they start buying massively because they have the foresight to know that recovery is imminent.

Despondency and Depression

Finally, the market starts recovering and starts the upward movement again. At this point, traders and investors begin to get depressed because they realize how much money they lost by selling near the low. They start to evaluate how a little more patience would have helped. This is where many begin to question their ability to trade and start considering if trading is the right path for them.

Hope

When the market remains stable in the upward trend for a while, traders start feeling confident and hopeful about trading again. This happens after being scared for a while, and the market cycle starts again.

Final thoughts

Any professional trader and investor knows that the financial market is volatile. However, it is when traders and investors step out of their trading comfort zone that they start making costly mistakes. Both greed and fear can be detrimental in the financial market. Whichever emotion is prevalent in the current market, you must stick to the basic fundamentals of trading and investing, which is Supply and Demand, in order to become consistently profitable.

The line between controlling your emotions and simply being stubborn is often blurry. In the financial market, it is crucial to develop and follow a rule-based Supply and Demand trading strategy. It is also necessary to regularly revisit your trading plan and Supply and Demand trading strategy and be both rational and flexible when you make changes to your trading plan.

If we are always giving in to the unstable emotions as illustrated by the diagram, we most likely will never reach our full potential or achieve our trading goals. The best and most productive approach is to implement a low risk but high probability Supply and Demand trading strategy that you follow strictly. This will help you through all the emotional cycles. We can train you on how to manage all these stages rightly at our online trading academy.

If you want to learn more about professional trading and investing across multiple asset classes such as forex, futures, and stocks, please sign up HERE for free at our online trading academy www.onlinetradingcampus.com and get access to a free three-hour introductory course.

Happy trading!

Author Bio: Bernd Skorupinski teaches the undiluted truth about trading and investing at Online Trading Campus and takes you through what it takes to be a consistently successful trader. His favorite moment as a trading mentor is the way peoples’ eyes light up with excitement and confidence when they understand how Supply and Demand trading strategy works and how it can help win in the trading arena. He believes in building core values and discipline that ensures his students do not succumb to the pressures and temptations of the market. He very much believes in following plans and strategy through. If you want to know more about the author Bernd Skorupinski please read HERE